Finding the right Medicare drug plan can be challenging, but Humana Medicare D makes the process easier by offering accessible and cost-effective prescription coverage. This type of plan is designed to help seniors and other eligible individuals manage medication expenses while ensuring they receive the prescriptions they need.

Understanding Humana Medicare D Prescription Drug Coverage

What is Humana Medicare D?

Humana Medicare D, also referred to as Medicare through Humana, is a plan that covers prescription medications. Approved by Medicare and delivered by private insurers like Humana, these plans give members access to a wide network of pharmacies and essential drug benefits.

Humana Medicare D includes a wide selection of brand-name and generic drugs. Its tiered system helps beneficiaries choose lower-cost prescriptions when available while maintaining access to critical medications.

Why Prescription Drug Coverage Matters

With the rising cost of prescriptions, having reliable coverage is more important than ever. Humana Medicare D helps reduce the financial burden of medication costs, especially for retirees and people with chronic health conditions. Without such coverage, out-of-pocket expenses can quickly become overwhelming.

Benefits of Choosing Humana

Humana Medicare gives members access to thousands of participating pharmacies nationwide. Whether in urban or rural areas, beneficiaries can conveniently fill prescriptions and even take advantage of mail-order services for added savings.

The company also provides a variety of plan options. Some feature lower monthly premiums, while others deliver more extensive coverage, ensuring that different financial and health needs are met.

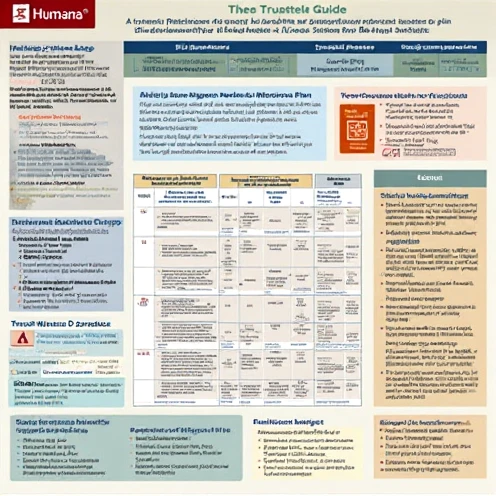

Comparing Humana Plans

Humana’s drug plans use a formulary system with cost tiers. Lower tiers often include generics at reduced costs, while higher tiers include brand-name and specialty medications that may require higher copayments.

Availability differs across states and counties, so it’s important to check which Humana options apply to a specific location. Reviewing this during the Medicare Annual Enrollment Period ensures that coverage matches local needs.

Enrollment Periods for Humana Medicare D

People first become eligible for Humana Medicare during their Initial Enrollment Period, which begins three months before turning 65 and lasts three months after. Enrolling early ensures there are no gaps in coverage.

Each year, the Annual Enrollment Period (October 15 – December 7) allows individuals to review and change their plans. Special Enrollment Periods are also available for life events such as moving or losing employer coverage.

Costs Associated with Humana Medicare D

Monthly premiums vary, with some plans offering $0 deductible options. Others may have deductibles that must be met before coverage begins.

After the deductible, beneficiaries typically pay copayments or coinsurance. Generics are usually the cheapest, while specialty medications may come with higher costs.

The Medicare Donut Hole and Humana Medicare D

The “donut hole” refers to the coverage gap in Medicare Part D. Once total drug costs reach a certain limit, members may pay more until catastrophic coverage begins.

Humana Medicare plans often provide additional savings during this stage, easing the cost burden with discounts on both generics and brand-name drugs.

Tips for Choosing the Right Humana Medicare Plan

Reviewing the formulary is key, as not all medications are included at the same cost level. It’s also important to confirm whether preferred pharmacies are part of Humana’s network.

Humana offers online tools to compare plans and estimate drug expenses. These resources help individuals identify the most cost-effective option based on their prescriptions and budget.

Additional Benefits of Humana Medicare D

Many Humana Medicare plans go beyond drug coverage by offering wellness programs, nurse advice lines, and health education. These extras help members make better healthcare decisions.

Mail-order pharmacy services allow beneficiaries to receive a 90-day supply of medications delivered to their homes, often at a reduced price.

Common Misconceptions About Humana Medicare D

Some assume all Medicare D plans are the same, but each has different coverage, costs, and formularies. Humana provides flexibility with several options to choose from.

Another common myth is that Medicare automatically covers prescriptions. In reality, a separate plan such as Humana Medicare is required to ensure drug coverage.

Final Thoughts on Humana Medicare D

Humana Medicare combines affordability with convenience and extensive coverage. Its wide pharmacy network, plan variety, and member support make it a strong choice for prescription drug coverage.

When comparing plans, consider costs, the formulary, and the pharmacy network. With careful review, seniors can select a Humana Medicare plan that offers reliable coverage and peace of mind.