Finding the right health insurance plan can feel overwhelming, but many individuals turn to Humana PPO for its flexibility and wide range of benefits. This type of coverage allows members to access large networks of doctors and hospitals while still keeping the option to see out-of-network providers. With healthcare expenses on the rise, Humana’s Preferred Provider Organization plans aim to give people affordable choices without sacrificing quality or convenience.

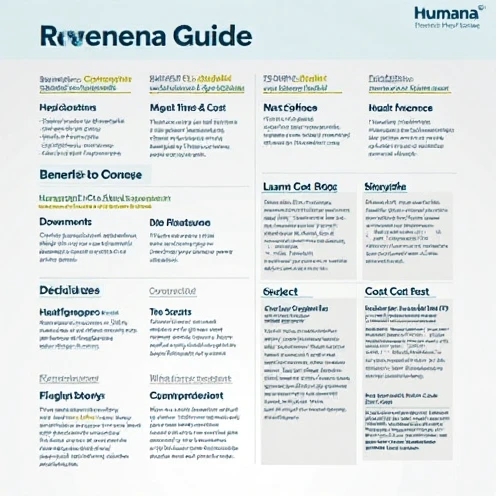

Understanding the Basics of Humana PPO Insurance

What Is a Humana PPO Plan?

A Humana PPO (Preferred Provider Organization) plan is a form of health insurance that gives members the freedom to choose their healthcare providers. Unlike HMO (Health Maintenance Organization) plans, PPOs do not require referrals for specialists and cover both in-network and out-of-network care. Staying within Humana’s network typically lowers costs, but you’re not restricted if you need to go outside of it.

For those who value flexibility—such as frequent travelers, remote workers, or families needing multiple types of care—Humana PPO is often the better fit.

How Humana PPO Works in Practice

Members of a PPO plan generally pay monthly premiums, plus deductibles, copays, or coinsurance depending on the care they receive. The biggest advantage lies in how simple it is to access care. You can schedule a specialist directly, without waiting for a primary care referral. This is especially useful for ongoing treatments or sudden health concerns.

Flexibility and Freedom of Choice

One of the most attractive features of Humana insurance is how much freedom it gives policyholders. You can visit any doctor or hospital of your choice, though choosing providers in Humana’s network usually keeps costs lower. This flexibility is invaluable for families or individuals who want the freedom to choose what works best for them.

Access to Nationwide Providers

Another strong benefit is the nationwide reach of Humana PPO plans. Whether you’re relocating, traveling for work, or living in a rural area, you can still find quality care. Unlike HMOs that often confine members to smaller regional networks, PPOs make healthcare more accessible wherever you are.

Preventive Care and Wellness Programs

Humana PPO plans emphasize preventive health. Members usually have coverage for annual checkups, immunizations, and screenings at little or no cost. Additionally, Humana offers wellness programs designed to encourage healthier lifestyles, such as fitness incentives, weight-loss support, and chronic condition management.

Prescription Drug Coverage and Pharmacy Options

Prescription benefits are another critical part of Humana PPO health insurance. The plan provides coverage for generic and brand-name medications across a wide network of pharmacies. Mail-order delivery is often included, making long-term prescriptions more convenient and affordable.

PPO vs. HMO: Which Is Better for You?

When comparing PPOs and HMOs, the main difference comes down to choice. An HMO typically requires you to pick a primary doctor and get referrals before seeing specialists. PPOs eliminate that extra step, offering a broader network and faster access to care. While PPOs often come with higher premiums, many find the added convenience worth the extra cost.

PPO vs. EPO and POS Plans

Other plan types, such as EPO (Exclusive Provider Organization) and POS (Point of Service), blend features of HMOs and PPOs. However, they often include stricter rules on provider access. The Humana PPO plan stands out because it merges freedom of choice with broad coverage, making it one of the most adaptable options.

Premiums, Deductibles, and Copayments

Costs are always an important consideration. Humana PPO members pay monthly premiums along with deductibles, copayments, and coinsurance. While monthly payments might be higher than other plans, the long-term savings from flexibility and access often balance out.

Balancing Cost and Coverage

The true value of a PPO comes in its flexibility. For families managing chronic conditions, or individuals who need frequent specialist visits, having the option to see providers without extra steps is often worth the additional monthly premium.

Telehealth and Virtual Care Services

Humana PPO members can also take advantage of telehealth, which has become increasingly important. Virtual doctor visits allow patients to receive care, prescriptions, and follow-up advice from home—saving both time and money while maintaining access to quality providers.

Wellness Discounts and Rewards Programs

Beyond basic coverage, Humana PPO plans frequently include extra perks. Members may receive discounts on fitness memberships, access to mental health resources, and lifestyle support programs that encourage healthier living. These benefits help members stay proactive about their well-being.

Who Benefits the Most from a Humana PPO Plan

The Humana PPO option is particularly suited for:

- Families with diverse healthcare needs

- Patients with chronic medical conditions

- Frequent travelers or multi-state residents

- Individuals who prefer flexibility over lower premiums

These groups often find that the advantages outweigh the costs, making PPO coverage a smart choice.

Making the Final Decision

Ultimately, your health plan should align with your lifestyle and healthcare priorities. If you value freedom, nationwide access, and fewer restrictions, Humana PPO is an excellent candidate. It balances affordability with flexibility, giving members confidence in their coverage.

Why Humana PPO Stands Out

In a crowded insurance market, Humana PPO plans distinguish themselves with extensive provider networks, preventive care, and lifestyle perks. While the costs may be slightly higher, the convenience and peace of mind make it an investment in both health and financial security.

If you want insurance that adapts to your needs rather than restricting them, Humana PPO is a plan worth considering.